do nonprofits pay taxes on donations

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Amount and types of deductible contributions what records to keep and how to.

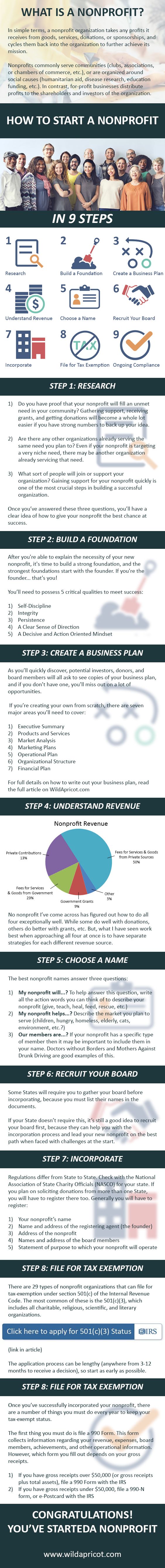

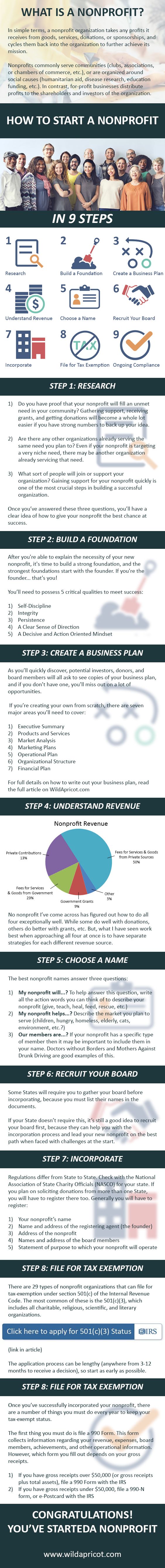

How To Start A Nonprofit In 4 Parts Nonprofit Startup Start A Non Profit Nonprofit Management

Section 501 c of the US.

. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the. Gifts or money you received as a present isnt taxable but you do owe taxes on any income it produces. A searchable database of organizations eligible to receive tax-deductible charitable contributions.

In short the answer is both yes and no. Support Miami Nonprofits With One Donation. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Do nonprofits pay taxes. However items withdrawn from. If you run for office -- whether its city councilor or president -- any donations to your campaign are tax-free income.

But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other employer. Internal Revenue Code lists 27 types of nonprofit organizations exempt from tax. Most nonprofits with a political agenda who publicly show support for or donate to a political campaign do not qualify for tax exemptions.

However here are some factors to consider when. Married filing separately. Here we break down.

One of the best ways you can encourage people to donate to your non-profit organization is by assuring them that their donation is tax-deductible. Other potential deductions include. Do nonprofit organizations have to pay taxes.

For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses. Do nonprofits pay payroll taxes. The Miami Impact Index Fund allows donors to donate to all Miami area nonprofits on The Giving Blocks platform with a single donation.

Do i need to pay tax on donations that were given to me. Still most are exempt under Section 501 c3 which gives an. Do non profits pay taxes on donations January 3 2022 At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite.

This only applies as long as you spend the money on your. Your recognition as a 501c3 organization exempts you from federal income tax. The research to determine whether or not sales.

Charitable donations are part of your itemized deductions. Most nonprofits do not have to pay federal or state income taxes. The company needs to issue 1099 forms to these workers so they can file their taxes with the Internal Revenue.

If a nonprofit company hires and pays non-employees the answer is yes. However this corporate status does not. Yes nonprofits must pay federal and state payroll taxes.

Donations to nonprofit organizations are not taxable PROVIDED the donation does not result in the granting of admission to an event or place.

Difference Between Charity Business Administration Think Tank

Donation Receipt Template Receipt Template School Fundraisers Receipt

Sponsorship Levels Event Sponsorship Donation Letter

50 Engaging Email Newsletter Ideas Giving Tuesday Email Marketing Design Giving

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Fundraising Letter

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Nonprofit Organization

How Not To Impress A Donor Proposalforngos Charity Work Ideas Fundraising Fun Fundraisers

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Tax Breaks For Homeowners And Renters Tax Deductions Deduction Renter

Non Profit Online Donation Forms Non Profit Humanitarian Projects Online Donations

Charitable Donations H R Block Best Time To Study Credit Card Infographic Infographic

A Brief History Of Charitable Giving Infographic Charitable Giving Infographic Charitable

Social Fundraising Tools For Nonprofits Causes Nonprofit Startup Fundraising Marketing Fundraising Activities

Non Profit Donation Letter For Taxes Google Search Fundraising Letter Charity Fundraising Non Profit Donations

How To Start A Non Profit Organization In Pennsylvania Paperwork Cost And Time Http Localhost Inform Start A Non Profit Non Profit Nonprofit Organization

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

The Inspiring 10 Treasurers Report Template Resume Samples For Fundraising Report Template Photo Below Is Oth Budget Template Budgeting Budgeting Worksheets